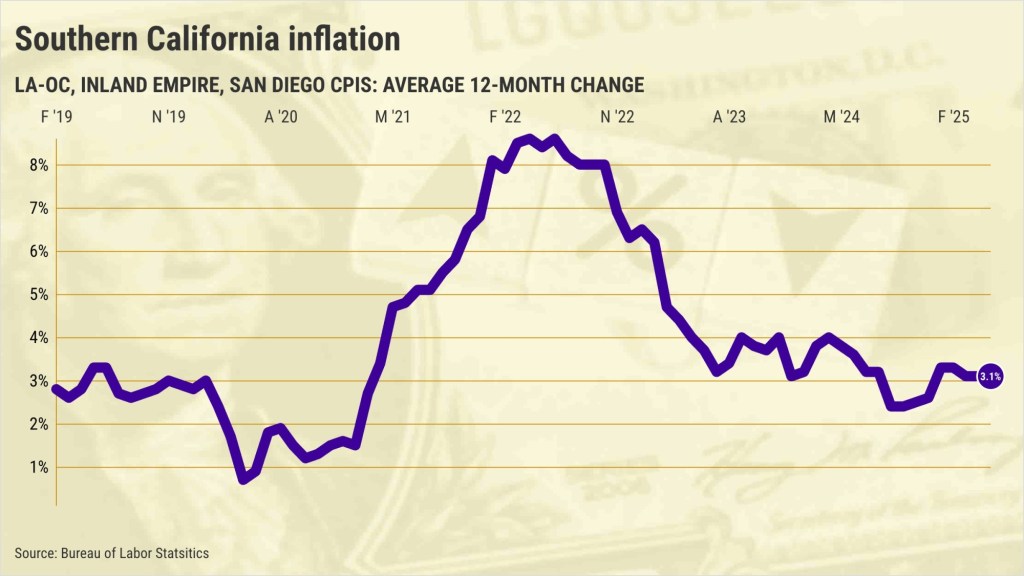

Southern Californians who thought inflation was all but cured are getting a rude surprise in 2025.

The region’s overall consumer prices were rising at a 3.1% annual rate in May. That’s according to my trusty spreadsheet, which averaged price swings in three local Consumer Price Indexes for Los Angeles and Orange counties, the Inland Empire and San Diego.

Yes, local inflation is down from its recent high of 8.6% in April 2022. But May’s average rate is a disappointing increase from September’s low of 2.4%.

Across the three metro areas, May inflation ran from 2.6% in the Inland Empire to 3% in L.A.-O.C., to 3.8% in San Diego.

Why is inflation stubbornly persistent? Well, there are a host of factors, ranging from the modestly robust job market generating noteworthy pay hikes, the lofty costs merchants are paying for the goods they sell or make, and international trade tensions, notably tariffs on numerous imported goods.

The pain

Local shoppers are feeling the pain of revived inflation at the supermarket.

Southern California’s “food at home” prices are up 1.9% in the past year vs. 2024’s best rate – a drop of 0.3% in September. By metro, grocery costs were rising 1.5% in the I.E., 1.6% in San Diego, and 1.7% in L.A.-O.C.

Dining out costs are rising even faster, up 5.8% over the past year vs. 2024’s low of 5.3% in August. Costs of ingredients and pricier labor – including a higher minimum wage for fast-food workers – are key causes. By metro for May: 5.4% in L.A.-O.C., 5.6% in I.E., and 6.9% in San Diego.

And paying for Southern California services hit the wallet hard, rising at a 4.4% annual pace in May vs. 2024’s best rate, up 1.1% in February.

Rising service costs are a good example of wage pressures employers are facing. Salaries are a considerable slice of service providers’ costs. These prices, by metro for May, rose 4% in L.A.-O.C., 4.2% in the I.E., and 5.1% in San Diego.

And, of course, there’s ever-costlier local housing – up 3.9% the past year vs. 2024’s best at 3.2% in February. By metro for May: 4% in L.A.-O.C., 2.9% in I.E., and 4.9% in San Diego.

And the progress

There was some local price progress in May.

For example, Southern California drivers found cheaper gasoline. By CPI math, it’s 9% more affordable in the past year as crude oil prices dropped. Yet May’s dip was nowhere near 2024’s biggest rate of decline – 20% in October. May’s drops at the pump ranged from 7.9% in L.A.-O.C., 8.2% in San Diego, and 9.1% in I.E.

And Southern California’s costs of “durables” – those big-ticket items such as cars, appliances and furniture – slipped at a 0.4% annual rate in the past year. That’s not 2024’s best discounting: 4.7% deflation in August.

And by metro, pricing was mixed for May with durables 1.5% cheaper in L.A.-O.C. but rising 0.9% in I.E. and 1.3% in San Diego.

Falling prices for durable goods – many of which are imported – suggest merchants are currently reacting more to consumer skittishness about larger purchases vs. any pricing pressures tariffs may create.

Jonathan Lansner is the business columnist for the Southern California News Group. He can be reached at jlansner@scng.com