Southern California homebuying in April ran far slower than the historical pace as near-record-high prices scared off house hunters.

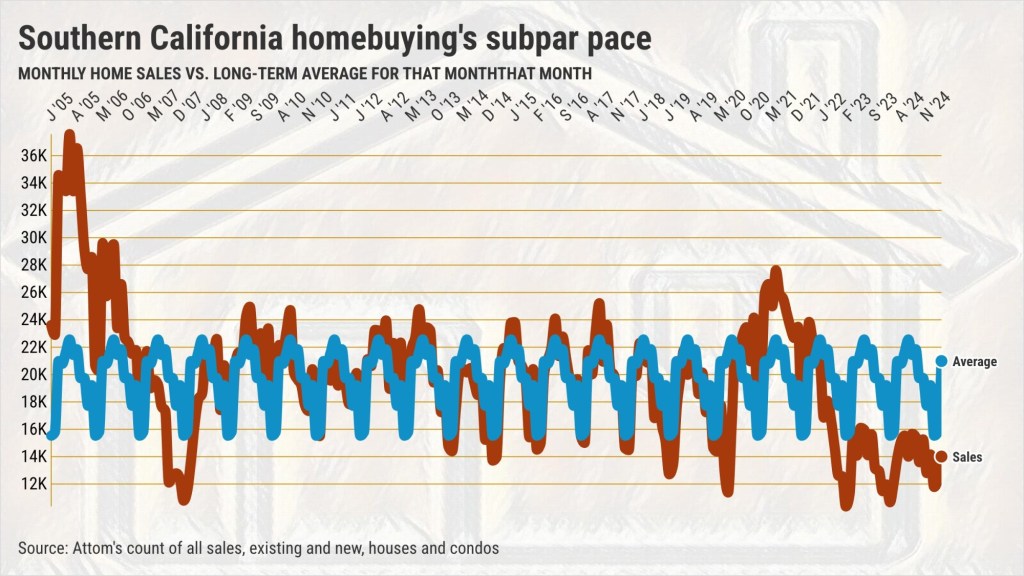

Sales closed on 15,622 houses and condos – existing and newly built – in the six-county region in April, according to real estate tracker Attom. My trusty spreadsheet shows that while Southern California’s transaction tally is up 4% in a year, it’s the fourth-slowest selling April in data reaching back to 2005.

Plus, and most telling, sales are 25% below the 21-year sales average for April. And this was the 36th consecutive month that the homebuying pace was below the historical norm for all months. By the way, local sales during the price-crashing Great Recession were below average for only 17 straight months in 2008-09.

It seems prospective homebuyers balked at April’s $820,000 median sales price, Southern California’s second-highest on record. It’s just $1,125 below the record $821,125 set in February.

The rare bright spot for wannabe buyers is that the region’s median price was up only 1% in a year. That was the smallest gain since June 2023, a potential signal that the sales downturn is chilling sellers’ price expectations.

Still, stubbornly elevated prices and high mortgage rates add to numerous economic hurdles for home seekers. That’s everything from persistent inflation to a wobbly job market, immigration debates and trade wars.

Ponder this: Southern California’s estimated monthly payment is $4,250 for a median-priced residence with 20% down – and that’s before adding property taxes, insurance and possible homeowner association dues.

Yes, this burden was actually down 1% over 12 months. Yet it remains 104% higher in six years. Yes, more than double.

Remember what mortgage rates have done, too. The 30-year fixed-rate averaged 6.7% in the three months ending in April, according to Freddie Mac math. That’s down a touch off 6.9% a year earlier. However, it’s far above the 4.3% rates of six years ago, before the pandemic twisted the real estate world.

These financial costs hammer a house hunter’s budget. It would take a $127,500 annual salary to keep April’s payment at 40% of a Southern California borrower’s income.

And don’t forget the $82,000 down needed to qualify for a preferred mortgage rate.

Same old story

The costly theme is the same in two key housing slices: sluggish buying and sky-high prices.

Sales of Southern California single-family houses in April ran 25% below the 21-year average as April’s $870,000 median was the fourth-highest recorded.

Even sales of cheaper condos sagged. Southern California sales ran 22% under par, as April’s $685,000 median was also No. 4 in the rankings.

This buying lull echoes across the state and nation.

California’s sales of all residences were 24% less than the average in April since 2005, with a $750,000 median tied for a record high.

Meanwhile, U.S. sales ran 11% below the 21-year pace, with the national $364,000 median and the No. 2 price all-time.

Counting the counties

Looking across the six-county region, curiously, the more affordable counties have some of the most significant sales dips. That reminds us that affordability woes often hit hardest for house hunters with smaller budgets …

San Bernardino: April sales were 32% below the 21-year average with the $530,000 median, the fifth-highest all-time and up 2% in a year.

Ventura: Sales are 27% below average, with a record $875,000 median, up 4% in a year.

Riverside: Sales are 26% below average, with a median of $608,000 (second-highest), up 0.5% in a year.

San Diego: Sales are 24% below average with a $900,000 median (third-highest), flat in a year.

Orange: Sales are 23% below average, with a $1.19 million median (fifth-highest), up 0.4% in a year.

Los Angeles: Sales are 19% below average, with a $890,000 median (fifth-highest), flat in a year.

Jonathan Lansner is the business columnist for the Southern California News Group. He can be reached at jlansner@scng.com