California house hunters are balking at high home prices – just like their fellow Americans.

The significant difference is that the rejected homes in California happen to be far more expensive than the typical U.S. house.

Please forget the “buyer’s market” vs. “seller’s market” debate that’s spun by many real estate influencers. This is a “nobody’s market” – basically, nobody’s wild about this market.

And the best cure would be falling home prices.

Let my trusty spreadsheet explain with a review of April sales, tracked by Attom. These figures are as broad of a view of homebuying as you can get, comprising closed deals for existing and newly built properties, houses and condos. The data goes back to 2005.

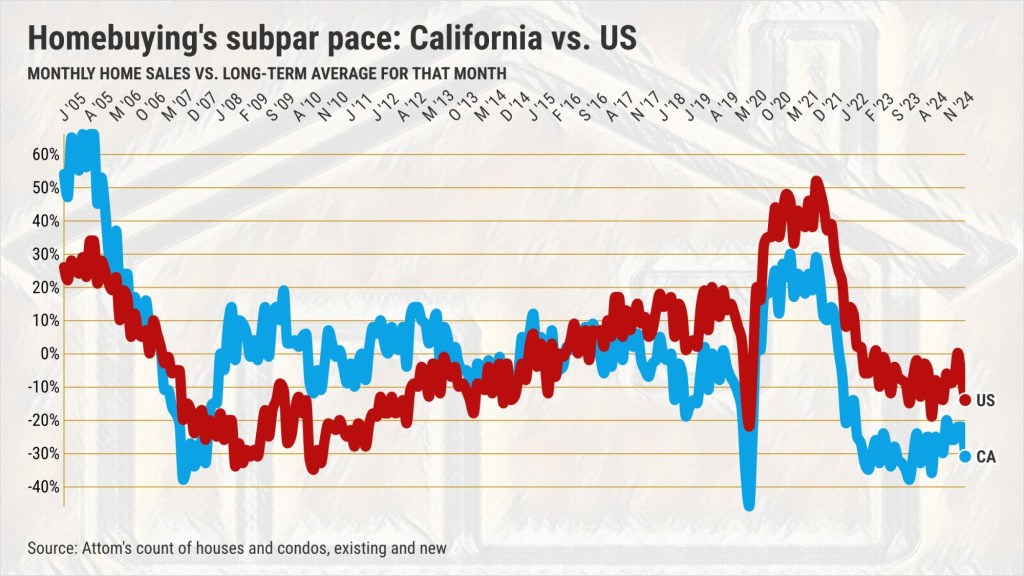

April’s numbers were ugly. It was the fourth-worst April for sales in California in 21 years. Seventh-slowest nationally.

Now, California sales are up 2% in a year vs. an 8% drop across the U.S. But look where those swings leave the respective markets.

California’s April sales were still 23% slower than the month’s 21-year average. It was the 35th consecutive month below a month’s historical homebuying pace.

Nationally, it’s a tad less sour: Only 10% below par for an April and 24 out of the past 25 months ran below par.

The price is wrong

Look, the culprit is the same: Ridiculously high prices.

In April, California’s median sales price rose only 1% in a year, but that was to $750,000. That equaled a record high set in June 2024.

Nationally, prices rose 4% in 12 months to $364,000. That’s only $1,000 away from the all-time high, also set in June 2024.

Fewer people paying more for any assets tells you that demand has thinned to primarily wealthier folks who can afford to be wrong about the market.

Mortgage morass

Contemplate sky-high pricing, plus the interest-rate morass that springtime buyers have had to wade through.

The 30-year fixed-rate mortgage averaged 6.7% in the three months ending in April vs. 6.9% a year earlier. But six years ago, before the pandemic upended the economy, rates ran 4.3%.

This translates to a California buyer with a $3,888 estimated monthly payment for April’s median-price residence. That’s assuming a 20% downpayment and ignoring property taxes, insurance and maybe even homeowner association dues. Oh, and there’s $75,000 down needed to get a preferred rate.

Stunningly, this housing expense yardstick is up 97% in six years. Yes, double! And nationally, there’s a very similar tale – just smaller numbers.

April’s typical American buyer got a $1,887 monthly payment. That’s 108% higher in six years. Well, at least the typical U.S. downpayment is only $36,000. Yes, only.

Discount rack

Sure, lower mortgage rates would provide a temporary fix. But do you expect mortgage rates to go back to April 2019’s 4.3%?

If they did, house hunters in California still face prices up 50%, while nationally the gain is 58% over six years. Meanwhile, average weekly wages are up 25% in California and 29% nationally in the same period.

This kind of affordability gap won’t be fixed with more overpriced new homes built or more overpriced existing homes listed for sale. Real estate gurus said homebuying would pick up when inventory increased. Well, house hunters have more options – and they’re still saying “No thank you!”

Sellers – individuals or builders – will face continued lethargic demand if they don’t act. Call the discounting “concessions” or “adjustments” or “incentives” or whatever soothes the psyche.

Just cut prices while thinking about what your favorite merchants do when stuck with mispriced or unwanted goods.

It’s time for housing to hit the discount rack.

Jonathan Lansner is the business columnist for the Southern California News Group. He can be reached at jlansner@scng.com