Here’s a smidgen of good news for California house hunters: Mild discounting is underway.

My trusty spreadsheet peeked at a Zillow report tracking total home values for the year ending in June and the pandemic era — February 2020 through June 2025. Zillow totaled all of its price estimates for every state and the nation. Mortgage liabilities were not deducted from those valuations.

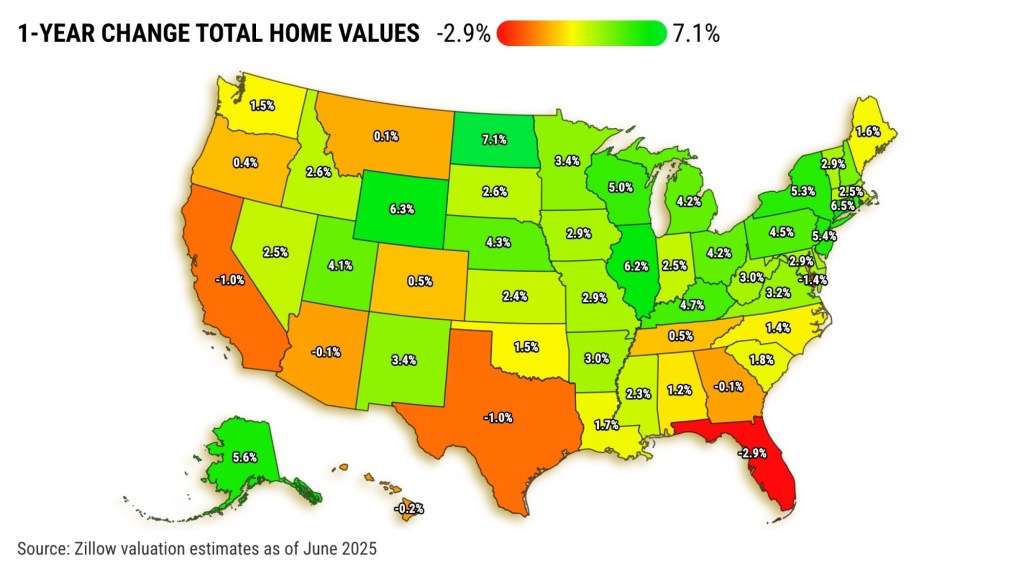

By this math, California’s total housing value dropped by $106 billion in the past year. Conversely, values across the U.S. rose by $862 billion.

California’s housing market has seen its sales pace drop to a low last seen during the 2008 crash. House hunters shy from near record-high prices. One affordability index shows that only 15% of California households could comfortably buy a typical house. Nationally, affordability is 34%.

Just seven states had their total values dip in the year. Only California’s economic arch-rival, Florida, had a bigger loss, at $109 billion. After California came another business nemesis, Texas, where values dipped $32 billion.

The biggest value gains were found in New York ($216 billion), New Jersey ($101 billion) and Illinois ($89 billion).

Despite the dip, homes in the Golden State are still worth a combined $10.8 trillion – that’s 20% of the national housing market’s $55.1 trillion valuation.

The No. 2 U.S. market in dollar size is New York ($4.3 trillion), then Florida ($3.7 trillion), Texas ($3.3 trillion) and New Jersey ($2 trillion). By the way, the smallest state market is North Dakota, at $90 billion.

So, on a percentage basis, California’s 12-month value drop equals a 1% loss vs. a 1.6% gain nationally.

Bigger percentage losses were found only in Florida, off 2.9%, and the District of Columbia, down 1.4%. Texas was also off 1%.

The largest gains? North Dakota at 7.1%, then Connecticut (6.5%) and Wyoming (6.3%).

Little help

These price dips are meek relief for California’s budget-busted house hunter, and for many wannabe homeowners across the U.S.

But the past year’s discounting is by no means any major cure. Ponder the huge price gains since February 2020, when coronavirus upended the housing market.

California’s values are up $3.4 trillion, No. 1 among the states and 17% of the nation’s $20 trillion gain. The No. 2 surge is Florida’s $1.6 trillion, then New York’s $1.5 trillion, and $1.2 trillion in Texas.

However, California’s pandemic-era jumps look modest on a percentage basis. That’s one reason why the affordability crisis is now a national headache.

California’s 46% price jump trailed the nation’s 57% advance. Only six places had smaller gains, topped by the District of Columbia (14%), Louisiana (31%), and Alaska (36%).

Think about the biggest surges: South Carolina (82%), Idaho (81%) and North Carolina (80%). Florida was No. 7, at 76%. Texas was No. 22 at 60%.

Few incomes kept up with the skyrocketing costs.

PS: For detailed valuation stats, go to bit.ly:june25values online.

Jonathan Lansner is the business columnist for the Southern California News Group. He can be reached at jlansner@scng.com