Californians suffer numerous stiff financial burdens, but on a national scale, credit card debt isn’t one of them.

My trusty spreadsheet analyzed debt data from earlier this year for the 50 states, including estimates of personal credit card balances and late-paying card accounts from WalletHub, as well as federal wage data and credit scores. To judge the burden of overuse of the plastic cards powering your wallet, the number of days of work required to pay off common outstanding credit card debts was calculated.

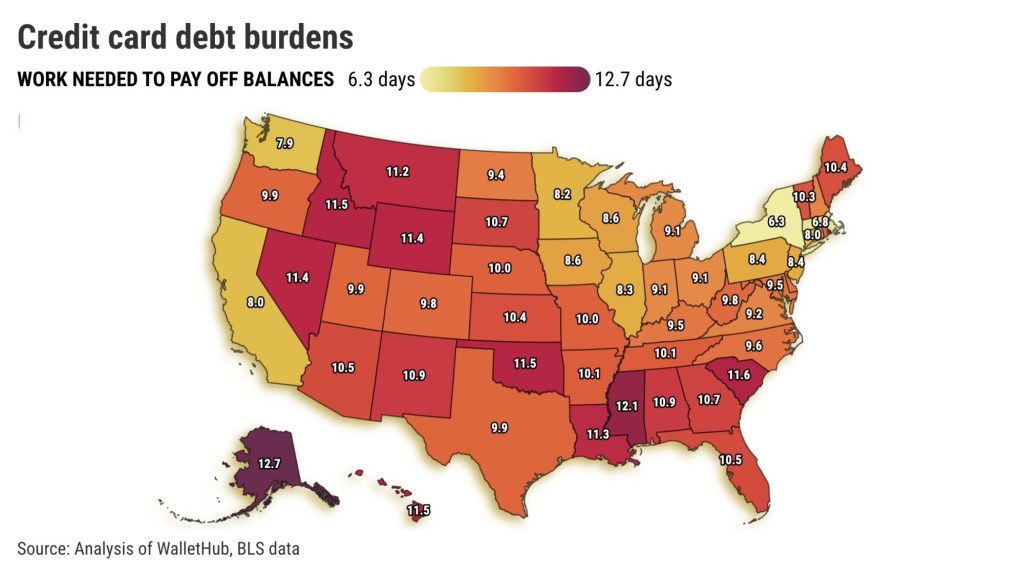

This math says that a typical Californian card balance is equivalent to eight days’ worth of the average wage. That ties Connecticut for the fourth-lowest burden among the states.

Californians’ credit card debt is also below the median 9.9-day burden across 50 states. Only New York (6.3 days), Massachusetts (6.8), and Washington state (7.9) were better.

Where are the steepest card problems? Alaska had the highest burden at 12.7 days, followed by Mississippi at 12.1, and South Carolina, Hawaii, and Oklahoma at 11.6.

What’s owed

How’d we tabulate the card burden? Let’s start with what’s owed, using a WalletHub analysis of TransUnion credit data as of April.

Californians who didn’t routinely pay off their card bills carried a $3,044 balance, the 12th-highest among the states and 11% above the $2,750 norm for all 50 states.

Alaska has the largest credit card debt at $3,683, followed by Colorado at $3,305 and Georgia at $3,186.

Conversely, the smallest balances were found in Iowa ($2,148), Wisconsin ($2,239), and West Virginia ($2,261).

To gain another perspective on this debt challenge, we divided the states into three groups ranked by their card burdens. Curiously, there was a negligible gap between what was owed in the 17 highest-burden states and the lowest burden ones.

Pay gap

What differentiated the burden was the size of the paychecks.

Consider a day’s pay in each state as measured by the Bureau of Labor Statistics in the first quarter. The 17 most-burdened states had a median daily wage of $249 vs. $321 in the 17 lowest-burdened – that’s 22% less pay.

The lowest daily pay was found in Mississippi at $204, in West Virginia at $230, and in South Dakota at $233.

California’s daily wage ranked fifth-highest at $381, 40% above the $273 median for the 50 states. Tops? New York at $443, Massachusetts at $421, and Connecticut at $396.

Paying on time

Big card burdens meant late payments.

The 17 high-burden states had a median delinquency rate of 20% while just 17% of card users in the 17 lowest-burdened states missed repayment, according to WalletHub’s late-pay stats as of the second quarter.

Mississippi had the highest delinquency rate at 37%, followed by Louisiana at 32% and Alabama at 31%.

California has a 15% delinquency rate, eighth-lowest among the states and below the 19% 50-state median. The fewest missed payments were in Florida and Iowa at 14%, then Vermont, Massachusetts and Hawaii at 15%.

What’s your score?

Having larger credit card debt also hurt one yardstick of bill-paying ability: the credit score.

Using statewide credit scores from Fair Issac as of April, the 17 states with the highest balance-to-wage burdens had a median FICO score of 707. Compare that to 725 for the low-burden states. Both are considered mid-range “good” scores on a scale of 300 to 850.

California’s 723 credit score ranked 28th best, above the national average of 715. The top three were Minnesota (743), Vermont (740), and Wisconsin (739).

The lowest scores were in Mississippi (677), Louisiana (687), and Alabama (691).

Clearly, big credit card debt is rarely a person’s only financial stress.

Jonathan Lansner is the business columnist for the Southern California News Group. He can be reached at jlansner@scng.com