The biggest news is not that the Fed cut short-term rates by one-quarter percent earlier this week with more to come, but that mortgage applications exploded, increasing nearly 30% compared with one week ago, according to the Mortgage Bankers Association.

The refinance index increased a staggering 58% from the previous week and was 70% higher than the same week one year ago. The purchase index was 20% higher than one year ago.

“Indicative of the weakening job market, and in anticipation of a rate cut from the Federal Reserve, mortgage rates last week dropped to their lowest level since October, with the 30-year fixed rate declining to 6.39%. Homeowners responded swiftly, with refinance application volume jumping almost 60% compared to the prior week,” said Mike Fratantoni, senior vice president and chief economist at the Mortgage Bankers Association. “Homeowners with larger loans jumped first, as the average loan size on refinances reached its highest level in the 35-year history of our survey,”

This week the Freddie Mac 30-year fixed rate averaged 6.26%, more than three quarters of a percent lower than the beginning of the year.

For an $806,500 loan amount, the principal and interest payment on 6.26% is $4,971. Freddie rates peaked this year in January at 7.04%. That principal and interest payment was $5,387 or $416 more per month than today.

Will this move the market?

“As they fall (mortgage rates), more buyers will qualify to purchase or refinance, and much of the stale inventory of overpriced houses will be absorbed,” said Patrick Veling, chief executive of Real Data Strategies. “It’s likely a very good time to buy before sellers’ figure all of this out and while many of them are motivated and depressed after being on the market for a while.

“If you get a mortgage in the process, I suggest that with future rate reductions coming in the next six to eight months, you get a loan that includes a free future refinance at a lower rate,” he said.

Veling also thinks once the inventory tightens, prices will either stabilize or begin another run up, depending on the supply-and-demand dynamics for each local market. But any hopes by naysayers for a significant downward adjustment in national real estate prices are now dashed.

High demand homes

Without a doubt, the toughest price range to land for buyers is the $900,000 to $1.3 million single family homes.

My clients, Ricardo Espinosa, a real estate agent, and his wife Michelle, a high school teacher, have been looking for a single-family home for the past year. They have two sons, so they’re looking to move them from a Glendale condo to a home with a yard.

Market conditions meant that what they were seeking was about $100,000 too expensive.

They waited out the market and prices came down as the market softened. With a $400,000 downpayment gift from their parents and the $100,00 price cut, they were able to close last week on a four-bedroom, three bath, 1,700-square-foot, $1,070,000 Pasadena home. They also were able to secure a 30-year fixed-rate under 6%.

“More buyers have been cautious about buying,” said Espinosa. “As rates have been coming down this home checked all the boxes.”

With homes at record-high levels, is this a good time to buy? Or is it cheaper to keep renting?

Another client of mine, Flavio Bravo, is helping his daughter buy her first home. She has a steady job and stable income. He and his wife are co-signing and providing a $80,000 down payment.

“As long as you are paying rent you are wasting all that money,” said Bravo. “Instead of spending on rent, invest in purchasing a home.”

Are we going to see the traditional holiday slow season for home sales?

“Rates have eased to their lowest level of the year, similar to last fall when rates were below 6.5% for 47 days, from the end of August to the start of October. That translated to additional pending sales and eventually closed sales for the remainder of the year,” said Steven Thomas, chief economist, Reports on Housing. “It looks as if history is repeating itself, yet this time, rates could remain below 6.5% for longer.”

Even though the job market is cooling and inflation is creeping up, I’m already experiencing a higher volume of phone calls for both purchases and refinances.

I agree with Veling and suggest house hunters buy now before home prices start moving up again. Make a deal with your lender to do a no-cost refinance when rates decline further.

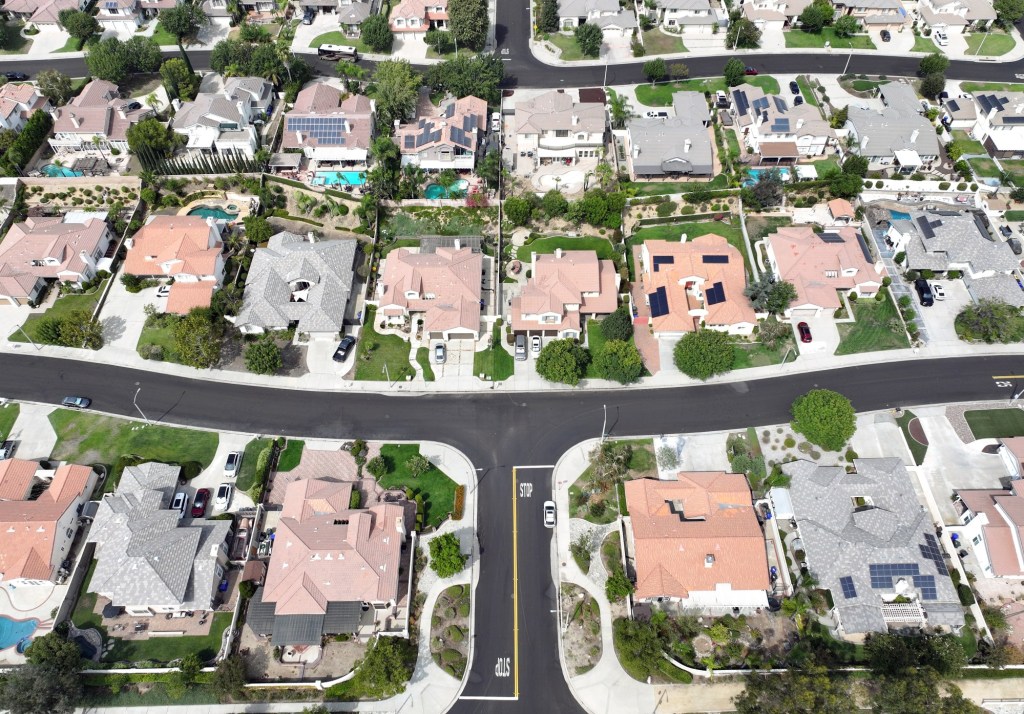

If you can only qualify for a shoebox on your own, consider getting a like-minded purchasing partner to share in the investment here in Southern California, the land of high cost housing.

If you are concerned about your job stability, or if you plan on moving in less than two years, don’t buy now. If you can’t pay your mortgage in the future, well that’s no good. And, if you are only there for a few years your transaction costs (both on the buy side and the sell side) may very well wipe out any property appreciation. And, then some.

Freddie Mac rate news

The 30-year fixed rate averaged 6.26%, 9 basis points lower than last week. The 15-year fixed rate averaged 5.41%, also 9 basis points lower than last week.

The Mortgage Bankers Association reported a 29.7% mortgage application increase compared with one week ago.

Bottom line: Assuming a borrower gets the average 30-year fixed rate on a conforming $806,500 loan, last year’s payment was $89 less than this week’s payment of $4,971.

What I see: Locally, well-qualified borrowers can get the following fixed-rate mortgages with one point: A 30-year FHA at 5.375%, a 15-year conventional at 4.99%, a 30-year conventional at 5.75%, a 15-year conventional high balance at 5.5% ($806,501 to $1,209,750 in LA and OC and $806,501 to $1,077,550 in San Diego), a 30-year high balance conventional at 6.125% and a jumbo 30-year fixed at 5.99%.

Eye-catcher loan program of the week: A 30-year mortgage, fixed for the first five years at 5.375% with 30% down payment and 1 point cost.

Jeff Lazerson, president of Mortgage Grader, can be reached at 949-322-8640 or jlazerson@mortgagegrader.com.