It has not been a pretty summer for consumers at California’s supermarkets.

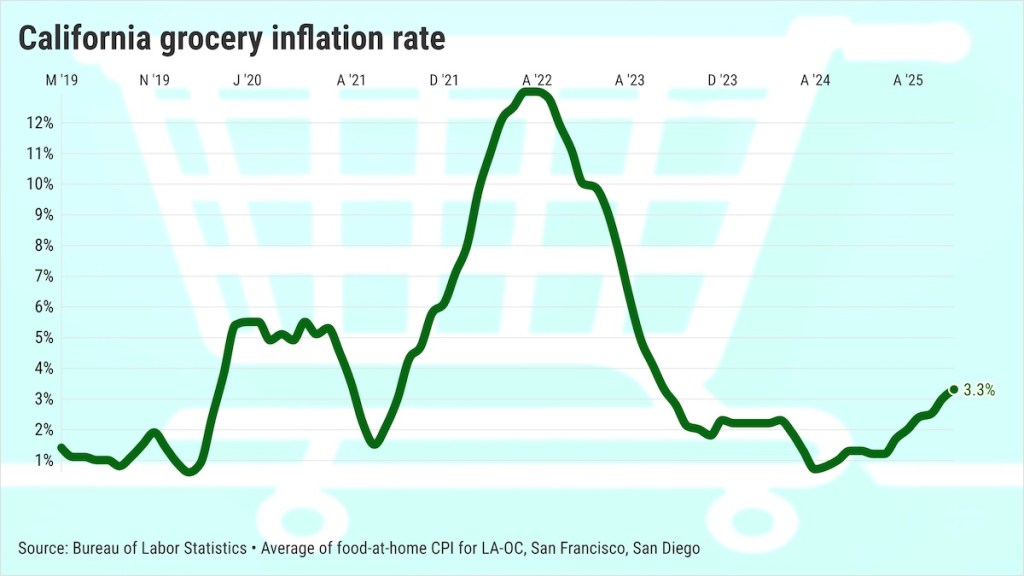

That’s what my trusty spreadsheet found when averaging slices of Consumer Price Indexes for three Golden State metro areas: the Los Angeles/Orange County combo, San Francisco and San Diego.

This summer’s pricing – June through August’s reports – shows that prices in the “food at home” category across those three metros grew at an average 3.3% annual rate this summer. So, grocery inflation more than doubled from 1.5% in 2024.

Yes, food at home inflation is nowhere near the pandemic era’s inflation surge that saw grocery prices balloon at a 6.4% average annual rate in 2021-23. Nevertheless, mid-year 2025’s California grocery inflation is running faster than the overall cost of living.

The overall Consumer Price Index for the three big markets averaged 3.1% gains this summer, the same as a year ago. During the 2021-23 inflation surge, this price yardstick grew at a 5% annual rate.

These recent cost-of-living gyrations, however, don’t mitigate the financial pain of the worst bout of inflation in four decades.

Take a longer-term view, as measured by the CPI: California groceries are 26% costlier over five years, as the overall cost of living rose 23%.

By the aisle

A chunk of this summer’s revived food inflation can be attributed to the higher costs of production and distribution. The new administration’s tariffs are making certain imported food more expensive.

Ponder the grocery categories tracked by local CPIs to see which California supermarket aisles are most troublesome to your household’s food budget. These are ranked by one-year increases …

Meats, poultry, fish and eggs: Up 4.3% annually this summer vs. 3% last year but off the 4.8%-a-year pace of 2021-23. Yes, the high-profile egg inflation has moderated. But beef prices soared — up 24% over five years — as drought has thinned herds and production costs have soared.

Fruits and vegetables: Up 4.1% annually this summer vs. 0.2% last year and 4.8% a year in 2021-23. Labor shortages have shrunk harvests while tariffs have upped import prices. These costs have increased by 20% over the past five years.

Nonalcoholic beverages: Up 3.4% this summer vs. 1.3% last year and 4.7% a year in 2021-23. Tariffs hit coffee. Costs for ingredients such as fruit and sugar have increased sharply. Prices are up 20% over five years.

Sweets, fats and oils: Up 2.9% this summer vs. 2% last year and 8.8% a year in 2021-23. Costlier sugar and cattle outweigh certain savings on grains. Yet these prices are up 35% over five years.

Alcoholic beverages: 2.7% this summer vs. 1.1% last year and the 3.6% average in 2021-23. Falling consumption keeps price hike modest – up only 15% over five years.

Dairy: Up 2% this summer vs. 0.7% last year and the 6.2% average in 2021-23. Prices are back on the upswing due to smaller herds and rising production costs. Prices are up 21% over five years.

Cereals/baked goods: Up 1.9% this summer, the same as last year, and nowhere near the 8.2% annually in 2021-23. Grain prices have returned to normalcy after the pandemic and the Ukraine-Russia war upset supply chains. Prices are up 31% over five years.

Dining out?

If a Californian thinks a meal on the town won’t hurt the budget, think again.

Yes, inflation in the “food away from home” category in the three big metros dramatically cooled this year. The industry is adjusting to increased ingredient costs and higher labor expenses.

This summer’s 3.6% one-year gain in dining out prices is down from a 6.3% surge last year and a 5.1% per year pace of 2021-23.

But dining out has seen quicker price growth than groceries or the overall California economy. Having somebody else cook is 28% costlier than it was five years ago.

Jonathan Lansner is the business columnist for the Southern California News Group. He can be reached at jlansner@scng.com