Hey, Inland Empire County, did you get an 18% raise in the last three years?

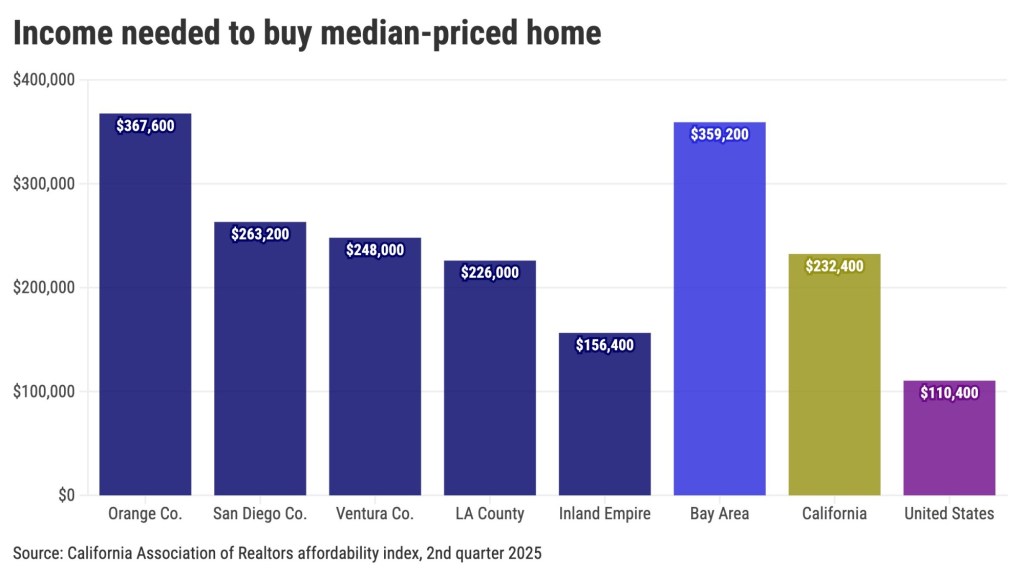

Well, that’s how much the required household income to buy a house has surged — up $24,400 to $156,400, according to my trusty spreadsheet’s comparison of the California Association of Realtors’ affordability report for the second quarter of 2025 vs. the numbers from the same period in 2022.

That income gets a house hunter the I.E.’s $610,000 median-priced single-family home, assuming 2025’s 6.9% interest rate compared to 5.4% three years earlier, along with the estimated costs for property taxes and insurance.

The house payment equals 30% of local household incomes. And the calculation also includes a 20% down payment.

Consequently, you’d also need $122,000 in cash to close a sale, too.

It’s just another example of how unaffordable local housing has become. Consider these expanding expenses, then ponder 15% wage growth across Southern California in the same timeframe, as reported by one federal pay index.

More for mortgages

Those pricier home loans are not simply due to the end of the Federal Reserve’s cheap money policy in early 2022.

The Fed also stopped buying mortgage bonds three years ago to keep rates low. The central bank had almost doubled its mortgage-bond holdings to $2.7 trillion during the pandemic’s economic turmoil to support the housing market.

What’s also boosting a buyer’s financial requirements is that I.E. house prices rose $25,000 since 2022’s second quarter – a 4% gain.

All this change adds up to a buyer’s monthly house payment growing by $610 – that’s an 18% jump – to $3,910.

Small flock

Who makes this kind of cash in the Inland Empire?

Well, Realtors estimated just 21% of households countywide could buy in the second quarter vs. 24% three years earlier.

That small flock of qualified buyers is a key reason why Inland Empire homebuying runs well below historic norms, according to sales data from Attom.

Shrinking affordability isn’t just a local problem.

The second quarter’s required income to buy California’s $905,680 median home was $232,400 – up $33,200 or 17% in three years. Just 15% can now afford to buy vs. 16% in 2022.

And nationally, buying the $429,400 U.S. median home required $110,400 in income, a cash flow that grew $17,200 or 18% since 2022. So, 34% of Americans qualify compared to 38% three years ago.

Jonathan Lansner is the business columnist for the Southern California News Group. He can be reached at jlansner@scng.com