California consumers haven’t been this skittish since the pandemic era’s business restrictions over four years ago.

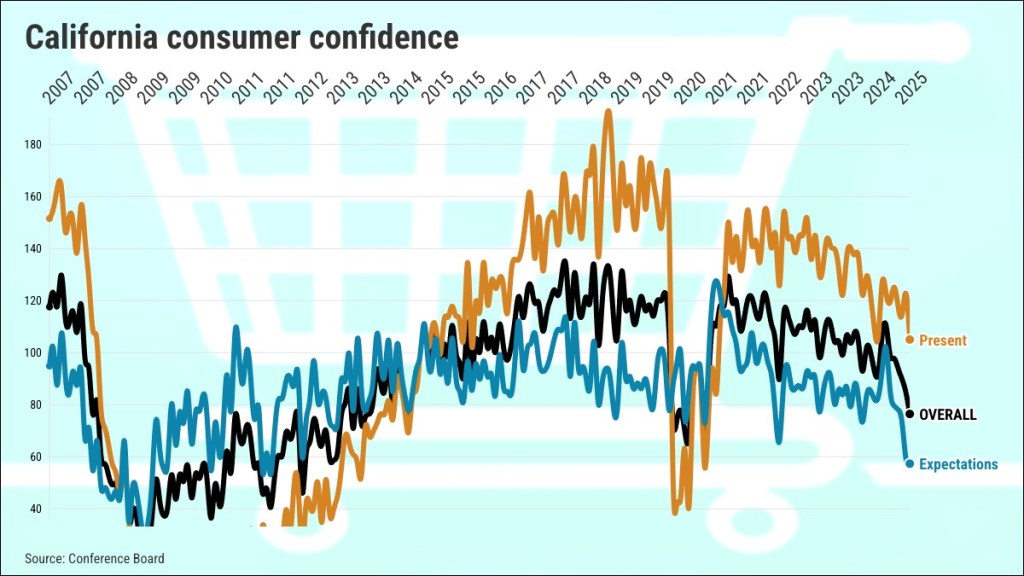

My trusty spreadsheet, when looking at April’s results for the Conference Board’s consumer confidence indexes, found statewide optimism down 31% since October, just before Election Day. This is the largest decline among the eight states tracked by these monthly measurements that are derived from a polling of shoppers.

Clearly, Californians worry about economic policies from the Trump administration, including trade battles with other nations and promises of large-scale deportations. Fears of a recession are now swirling as California’s hiring rate plummets to a 14-year low.

And let’s remember, Californians decidedly voted against Donald Trump.

All those gyrations helped cut the Golden State’s confidence to its lowest level since December 2020, a time when the economy was rocked by coronavirus lockdowns. This comes after statewide confidence fell 10% in April to sit 16% below its 18-year average.

Why worry?

For a state economy with a global focus, the new administration’s inwardly focused economic views aren’t seen as good news.

Californians are very nervous about the future. Consider the Conference Board’s forward-looking “expectations” index for California. It fell 4% in April to a statistical valley that’s 44% below October and 33% below average.

Californians also have growing concerns about today’s economy.

The current conditions index fell 15% in April, the largest one-month drop in over four years. That put this index down 14% since the election. Still, current conditions as view through this lens remain 7% above average.

Not alone

The drop in consumer confidence isn’t a California quirk.

Nationally, there’s been a 22% drop since October to a level that’s 6% below its average since 2007 – and the worst since May 2020.

Again, it’s the cloudy future. U.S. expectations are off 41% since the election to a low not seen since October 2011, and 34% below average.

But there’s some faith in the ongoing business climate. The U.S. current conditions index is down only 2% since the election and is still 27% above average.

Geographically speaking

Since the election, confidence also dropped in six of the other seven states tracked. Here’s a look at those index swings, ranked by their change in optimism from October …

New York: 28% drop in confidence over six months to 4% below average.

Illinois: 26% drop to 1% below average.

Texas: 16% drop to 16% below average.

Florida: 16% drop to 0.2% below average.

Pennsylvania: 15% drop to 0.2% below average.

Ohio: 9% drop to 7% above average.

And then there’s Michigan, where Trump’s tariff policies are expected to hurt the state’s big auto-related businesses. Confidence there is up 4% since the election to 21% above average.

Jonathan Lansner is the business columnist for the Southern California News Group. He can be reached at jlansner@scng.com

Originally Published: